Since 2006, the Dreier Chair in Accounting Ethics Distinguished Speaker Series has brought prominent executives and local business leaders to campus to recount their experience and share their knowledge on some of the biggest issues in accounting ethics, governance and the public interest. This elite program organized by the Institute for Business Ethics and Sustainability allows students, faculty, alumni, staff and members of the community the opportunity to hear firsthand about the complexities of the business world, while inspiring them to seek new ways to meet the challenges of tomorrow.

Past Speakers

-

"From the Bluff to the Boardroom: A Conversation with Avery Dennison's Corporate Trailblazer"

Mitch Butier, Executive Chairman, Avery Dennison Board of Directors

April 2, 2025The Dreier Chair in Accounting Ethics Distinguished Speaker Series welcomed Mitch Butier '93, executive chairman of the Avery Dennison Board of Directors. Mitch previously served as president and CEO of Avery Dennison, a global materials science and digital identification solutions company. In a fireside chat with Larry Kalbers, R. Chad Dreier Chair in Accounting Ethics, Mitch shared his journey from LMU accounting student to head of a Fortune 500 global corporation. He discussed his lengthy career at Avery Dennison, including insights on leadership, teamwork, ethics, and sustainability.

-

"The Moral Backbone of the Capital Markets: Exploring Investor Protection and the Future of Auditing"

George R. Botic, Public Company Accounting Oversight Board (PCAOB)

October 21, 2024The Dreier Chair in Accounting Ethics Distinguished Speaker Series welcomed George R. Botic, a member of the Public Company Accounting Oversight Board (PCAOB). Our country’s financial reporting ecosystem is in a period of transformation in reaction to factors like artificial intelligence, a talent shortage, and private equity investment. Mr. Botic discussed how these factors and others may shape the audits, auditors, and audit firms of the future. This event was co-sponsored by the Accounting Society and Delta Sigma Pi.

Read his full remarks here.

-

"My Journey and Your Journey: Exploring the Opportunities of the Coolest Profession Around (CPA)"

Tayiika M. Dennis, CPA, Principal, CliftonLarsonAllen (CLA)

March 27, 2023The Dreier Chair in Accounting Ethics Distinguished Speaker Series welcomed Tayiika M. Dennis, CPA, principal at CliftonLarsonAllen (CLA), the 8th largest accounting firm in the U.S. Tayiika also serves as chair of the CalCPA Board of Directors. With more than 20 years of experience in both public accounting and private industry, Tayiika provides audit and tax services for nonprofit organizations, with a special focus on social service organizations, arts and cultural organizations, and private foundations. Prior to CLA, she worked at a large international CPA firm, a regional CPA firm and at Universal Studios as a financial analyst.

-

"The Biggest Change to Sustainability in 40 Years That ISN’T Climate Change: Sustainable Capital Markets"

Nicolai Lundy, Chief of Marketing Relationships, Value Reporting Foundation

April 4, 2022The 1980s introduced the public to what was already considered a scientific consensus: CO2, methane and other emissions created a greenhouse gas effect. 40 years later, we’re on the cusp of globally standardized sustainability disclosure that will embed sustainability into the daily functions of the capital markets. There is broad consensus among institutional investors and corporations that sustainability can pose risks and opportunities to a company’s current and future value. But there hasn’t been consensus about what sustainability information is most helpful for analyzing those risks and opportunities – until now. The IFRS Foundation has established the International Sustainability Standards Board (ISSB) to help investors compare companies, identify leaders and laggards, and direct capital accordingly.

Nicolai oversees corporate and investor outreach efforts, communications, and education and partnerships at the Value Reporting Foundation, which resulted from the merger of IIRC and SASB. The Value Reporting Foundation focuses on the financial impacts of sustainability and the benefits of a holistic view of value creation. In summer 2022, the Value Reporting Foundation is consolidating with the IFRS Foundation to staff the work of the ISSB.

-

"Advancing DEI Initiatives in the Workplace: Skills and Values for Success"

Michelle Wroan, Managing Partner KPMG

April 20, 2021Michelle Wroan is a managing partner at KPMG Los Angeles. Michelle presented on KPMG’s initiatives on diversity, equity and inclusion, and discussed the skills and values that are important for success in the accounting profession. Michelle has been with KPMG for nearly 30 years and currently leads over 1,500 professionals in the audit, tax, and advisory services division. She is passionate about advancing women in the workplace and helped found the L.A. chapter of KPMG’s Executive Leadership Institute for Women. Michelle earned a B.S. in economics from UCLA and is a graduate of KPMG’s Lead Partner Academy at the Wharton School of Business and KPMG’s Executive Leadership Institute for Women.

-

"Building a Career and a Company on a Foundation of Ethics and Integrity"

Rene LaVigne '83, President and CEO of Iron Bow Technologies

January 27, 2021Rene shared how he uses ethics and integrity as a foundation for his life and career. He also discussed how diversity, equity and inclusion have impacted his career and how he addresses these issues in his company. Finally, Rene spoke on how his company and clients have adapted to the coronavirus pandemic.

-

"Busting the Myths: How Legislation, Regulation and Litigation Have Made Classic Big 4 Business Assumptions Obsolete"

Francine McKenna, journalist and public commentator

March 2, 2020McKenna’s remarks focused on modernizing perceptions of some of the common global audit firm business model myths perpetuated by the accounting industry, regulators, academics, judges, business leaders and the business media. Not knowing the facts is an obstacle to professionalism, serving the true client—investors, and promoting ethical capital markets.

McKenna is a prolific writer and commentator on the accounting, audit and corporate governance issues affecting public and pre-IPO private companies. Since 2006, she has been an investigative reporter and feature writer for publications including Dow Jones MarketWatch, Forbes, American Banker, Financial Times, Accounting Today, and Boston Review.

Before turning to journalism and academia, McKenna spent more than 20 years in public accounting and consulting, including for as a managing director for KPMG/BearingPoint in the U.S. and Latin America, and as a director for PwC, auditing the firm itself in the post-Sarbanes-Oxley era.

-

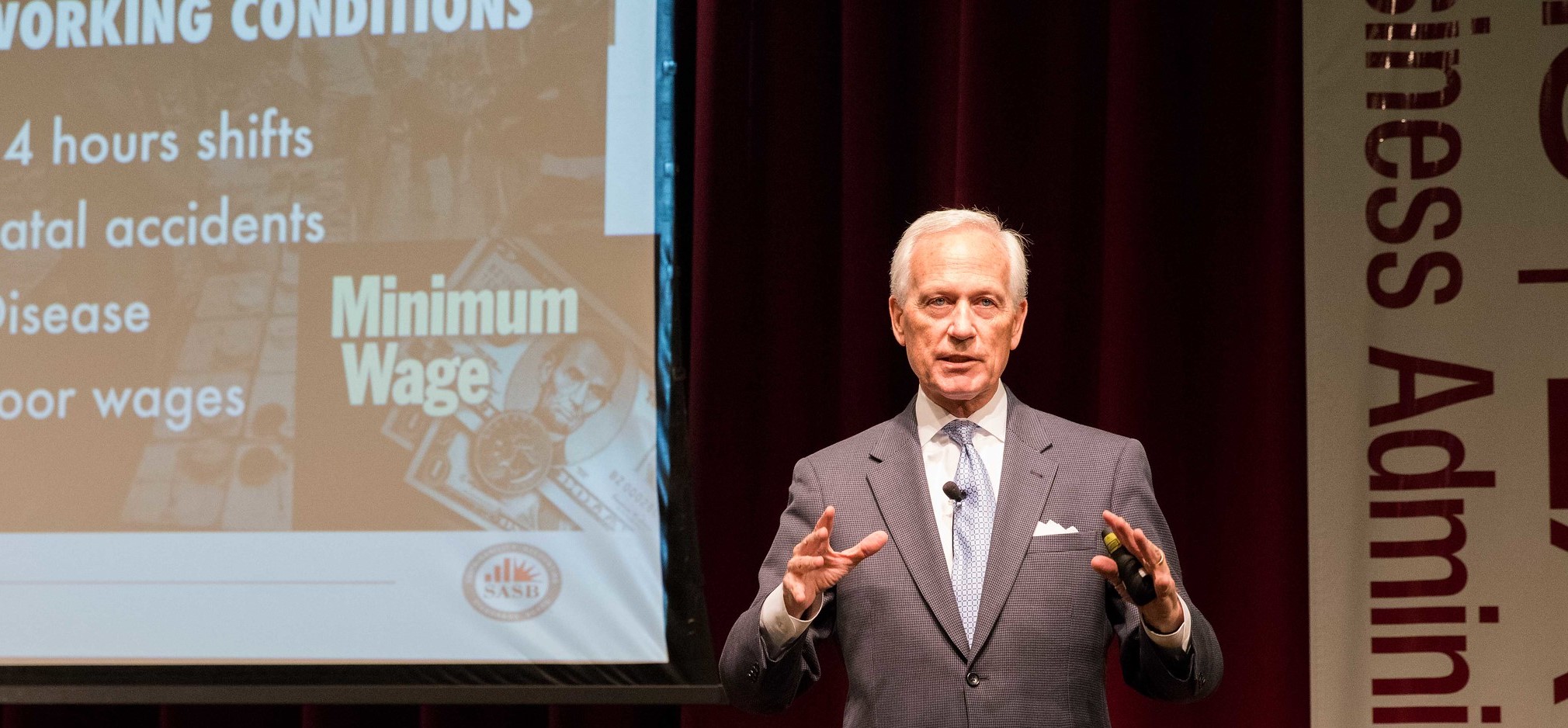

“What is the SASB and Why Should You Care?”

Robert Hirth, Senior Managing Director at Protiviti and Co-Vice Chair of the Sustainability Accounting Standards Board (SASB)

October 16, 2019The Sustainability Accounting Standards Board (SASB) has developed a complete set of 77 industry standards, providing a complete set of globally applicable industry-specific standards that identify the minimal set of financially material sustainability topics and their associated metrics for the typical company in an industry. Mr. Hirth discussed the sustainability evolution to ESG (Environment, Social, and Governance) reporting and why this is important to investors from a risk and valuation perspective. His presentation explained how corporate reporting has expanded to include this information and gave examples of companies doing this well, including those getting third party assurance on their information.

-

“Managing a Business at the Intersection of Profit and Purpose”

Sampriti Ganguli, CEO of Arabella Advisors

April 2, 2019As CEO, Ms. Ganguli oversees all aspects of the firm’s performance, and is also responsible for enhancing systems and policies that enable Arabella to deliver on its mission—to help foundations, philanthropists, and investors who are serious about impact achieve the greatest good with their resources. She advises corporations, individuals and foundations how to help advance their strategic philanthropy. Prior to Arabella, Sampriti worked at CEB (now Gartner), JPMorgan Chase, and the World Bank. Sampriti received a BA from Swarthmore College, an MA from Johns Hopkins SAIS, with a focus on Southeast Asia and an MBA from the University of Pennsylvania’s Wharton School.

-

“The 10-K and the Search for Meaning - Has Financial Reporting Lost Its Way?”

Richard Kravitz, Editor in Chief, The CPA Journal - The Voice of the Profession; Managing Director of Content and Publishing, New York State Society of CPAs

April 9, 2018The value and nature of capital of 21st century companies are not adequately represented in the current financial reporting model. Mr. Kravitz examines those hidden intangibles - assets that can create or destroy value but don't appear anywhere in the financials. He explains the nature of six capitals (financial capital, reputational capital, manufactured capital, human capital, social/relationship capital and natural capital) and the implications for global sustainability and the impact on society.

-

"Environmental, Social and Governance (ESG) Challenges and Opportunities"

Steven Burdick, Executive Vice President & CFO at Tetra Tech

September 26, 2017The changing regulatory and political environment presents new challenges and opportunities for environmental, social and governance practices. Steven Burdick discussed Tetra Tech’s business model; sustainability initiatives and sustainability reporting; the impact of the changing regulatory and political environment on environmental, social and governance practices; and shareholder value and long-term investment returns.

Pasadena-based Tetra Tech is a consulting and engineering firm focused on water, the environment and infrastructure projects. Burdick, a graduate of Loyola High and Santa Clara University, was taught the importance of social issues at an early age and grew up wanting to make a difference in people’s lives. Tetra Tech is the perfect fit for him. The company works in a lot of developing countries to provide water and electricity systems, and partners with nonprofit groups such as Engineers Without Borders and the STEM Education Coalition. Recent projects include the Panama Canal Expansion, Inner Harbor Navigation Canal, a U.S. Army facility in Utah powered by the sun, and a smart, sustainable city in Kenya that serves 200,000 people.

In 2011, Tetra Tech began measuring sustainability efforts and setting standards for its projects. It’s not just ESG but economic issues as well; companies need to be able to measure and figure out if they’ve been successful. While more companies today are reporting on sustainability, there is no single reporting standard; it is very fragmented. In 2015, 81% of S&P 500 companies were involved in sustainability reporting.

Since the 2016 election, ESG funding has increased 75%. Why? Because environmental protection drives economic growth and capitalism drives innovation. 85% of investors use qualitative information to make investment decisions. Intangible assets account for 80% of a company’s reporting. A higher percentage of women and millennials are now investing in ESG funds. So why are people investing in ESG funds?

- Risk management/mitigation

- Innovation

- Cost savings

- Premiums on stock multiples

- Improved retention/morale

- Better stock performance

“As more investors link sustainability with financial returns, they press companies for meaningful ESG disclosures,” said Burdick. “As a company, if you ignore ESG, you will be worth less.”

-

"Redistribution is a Four Letter Word"

Edward Kleinbard, Johnson Professor of Law and Business at USC

March 20, 2017Edward Kleinbard is a strong proponent for a larger government which he believes will lead to more economic growth. He says government exists to spend, not to tax. Government should purchase investments and insurance with money raised through taxes.

“The economic pie gets bigger when government complements the private sector,” said Kleinbard. “Small-government mentality beggars our future and adds to inequality.”

Contrary to popular belief, the U.S. is a low tax, small government economy that does very little redistribution. Kleinbard illustrated this point by comparing the U.S. to Germany, a country which instates a 10% higher tax rate yet has considerably lower levels of inequality. Though Germany’s tax system is less progressive, it has a strong commitment to public infrastructure and insurance. And while the U.S. has the most progressive tax system of all countries, it also has one of the highest levels of inequality.

In 2015, the Organization for Economic Cooperation and Development (OECD) stated that rising income inequality has a significant impact on economic growth, in large part because it reduces the capacity of the poorer segments – the poorest 40% of the population – to invest in their skills and education. For example, the U.S. spends more on public education of rich kids than poor kids. Even mediocre rich kids are getting into the best universities and snagging the most high-paying jobs.

These economic issues drive social anger which results in several trends: rising top-end inequality (top 1% controls 42% of national wealth), fading belief in equality of opportunity and stagnant incomes of the middle class lead to rage at working harder but falling further behind, conviction that the game is rigged against us, and repudiation of connection to fellow Americans. The U.S. also has the highest adult poverty rate as well as the highest ratios of rich to poor in the OECD.

The future of the U.S. depends on us working together as a democracy. The fiscal soul of the U.S. is in peril and something must be done. As citizens, we must have institutionalized empathy and connect with our fellow Americans through common action.

-

"Are Accountants Relevant in Today's Digital World?"

Lynn Turner, Senior Advisor with Hemming Morse's Forensic and Financial Consulting Services Group

October 4, 2016In today's digitally connected world, technology is replacing accountants, transparency has become mandatory, investors are increasingly turning to indexing and away from active management, and the quality of audits has been called into question. If the accounting profession is to maintain its relevance and value proposition to those who depend on it, what must it do?

Lynn Turner is the first speaker to be invited back for an encore presentation since the Distinguished Speaker Series launched 10 years ago. As senior advisor with Hemming Morse’s Forensic and Financial Consulting Services Group, member of the PCAOB Investor Advisory Group, and former chief accountant at the SEC, there are few more qualified or experienced than Lynn to discuss the current state of the audit industry.

Lynn, who started his career as an auditor at PricewaterhouseCoopers, began by stating that auditing has been around since the 1890s and posed the question: “What is the value of an audit today?” Congress mandated independent audits of public companies in 1933 and the process hasn’t changed much since then.

Lynn revealed a major issue with the quality of audits and shared figures that shocked the audience. Today's audit deficiency rate hovers somewhere between 35-40%. Error rates are especially high for the Big 4 accounting firms (up to 50%!) In a survey last year, public company CFOs estimated that 18% of companies manipulate their earnings by an average of 10%. What seems to be happening is auditors know a problem exists but don’t report it. Fraud reporting is often reported by the press (Enron), insiders (Xerox and WorldCom), independent research firms or hedge funds, trustees and regulators (Fannie Mae).

Not only has the auditing process remained the same over the last 40 years, but there’s often a too cozy relationship between auditor and issuer. Interestingly, Europe is way ahead of the U.S. in auditing control standards; they now require the rotation of auditors and auditing reports are detailed and thorough. Another problem is that most audits are done by young inexperienced people who don’t fully understand the business.

So what needs to change? According to Lynn, we need to change the business model of how audits are done, auditors need to recognize that the investor is the customer, use tools available by Wall Street and accountants need to have master’s degrees. Lynn doesn’t expect to see real changes in the near term; in fact, it might not happen until the next blow up. Until then, he encouraged LMU accounting students to be honest, ethical professionals and continue to push for industry change.

-

“What it Takes to be a Whistleblower in America, and What it Takes Out of You”

Tony Menendez, Litigation Consultant at Financial Fraud Examiner LLC

September 29, 2015Best known as the “Accountant Who Beat Halliburton,” Tony Menendez recounted events leading up to the 2006 investigation into Halliburton’s questionable accounting practices and share what it took to fight against a powerful organization. Tony has 20+ years of experience working at, auditing or providing technical accounting and reporting guidance to some of the largest public and private companies. Today, he is a top controller with General Motors. His story gives tremendous insight into what it takes to be a corporate whistleblower in America.

-

"How Investors Become Road Kill on the Path of Least Resistance"

Rick Fleming, Investor Advocate at the U.S. Securities and Exchange Commission

March 4, 2015In his lecture, Rick Fleming discussed the influence of industry in the regulatory system, and argued that investors need to be more vocal in order to avoid becoming road kill in the rulemaking process. Fleming leads an office charged with promoting the interests of investors by analyzing the impact of proposed rules and regulations, identifying problems investors have with financial service providers and investment products, and proposing regulatory changes.

Fleming kicked off his presentation by demonstrating via an actual ladder the steps needed to achieve economic success. Step 1 is get an education; Step 2 is get a job; Step 3 is save money; and Step 4 is invest in yourself or other businesses. The problem is investors are at risk of losing their nest egg because they are in a vulnerable position and considered attractive targets for scams. After the Great Depression, the government set out to protect investors and boost the economy by initiating federal securities laws.

The same thing happened after the 2008 financial crisis. Median household income fell almost 40% as a result of falling home values, plunging stock values and high unemployment. As a result, Congress enacted the Dodd Frank Act to enhance regulation of financial firms and restore faith in the economic system.

Fleming walked the audience through the evolution of a rule – the SEC issues a proposed regulation followed by a comment period and ending with the SEC adopting the final rule. A trend he’s noticed is that rules tend to be more favorable to industry.

“I’m trying to figure out why this keeps happening,” said Fleming. “I think it’s human nature to follow the path of least resistance. Most arguments come from powerful law firms representing industry. There needs to be less rational apathy on the part of investors.”

So how do we fix this? According to Fleming, two things need to happen: 1) investors need to be more vocal in the process and 2) the SEC has to stop counting comment letters like they’re votes.

“I’m genuinely concerned about Americans’ outlook on the future,” said Fleming. “Half of Americans expect future generations to be worse off and over half say political/economic systems are stacked against people like them. I’m setting out to change these perceptions.”

Prior to joining the SEC, Mr. Fleming spent 15 years as a state securities regulator, including more than a decade as General Counsel for the Office of the Kansas Securities Commissioner. He moved to Washington, D.C. in 2011 to become the Deputy General Counsel for the North American Securities Administrators Association (NASAA), where he provided assistance to state securities regulators and supported the activities of various project groups, primarily in matters involving enforcement and corporation finance.

-

"We Are Better Than This: How Government Should Spend Our Money"

Edward Kleinbard, Johnson Professor of Law and Business and USC

November 18, 2014“I want to encourage each of you to become more involved in the role of government today and what we can accomplish with a larger government in place,” said Edward Kleinbard to a packed audience of Loyola Marymount University business students, faculty, staff and alumni.

Kleinbard is the Johnson Professor of Law and Business at USC’s Gould School of Law and a Fellow at The Century Foundation. Prior to these appointments, he served as Chief of Staff of the U.S. Congress’s Joint Committee on Taxation.

In his presentation, Kleinbard highlighted several themes from his new book titled “We Are Better Than This: How Government Should Spend Our Money.” In the book, he explains how the public's preoccupation with tax policy alone has obscured any understanding of government's ability to complement the private sector through investment and insurance programs that enhance the general welfare and prosperity of our society at large.

“Both conservatives and progressives get it wrong,” says Kleinbard. “We need more government, not less. We must focus on cut and dry issues.”

He says a bigger, more muscular government is desirable, responsive and necessary for the following reasons:

- Desirable because the national economic pie gets bigger when government complements the private sector through well-designed investment and social insurance.

- Responsive to soaring income inequality.

- Necessary because government investment and insurance are the only ways to address incomplete private markets and to ensure inequity of opportunity.

Rising inequality is very real in our nation. The U.S. gap between rich and poor is wide. There’s a clear correlation between school test scores and median home prices. In other words, the government spends more on public education for rich kids than poor kids. The U.S. also accepts much more poverty than other countries. According to Kleinbard, regressive taxes can fund progressive fiscal systems.

Kleinbard proposes a two percent solution: increasing federal government spending by two percent of GDP would open many opportunities.

“When we choose how government should spend and tax, we open a window into our national fiscal soul,” said Kleinbard.

A few other revelations from his talk:

- Government exists to spend, not to tax; taxation is just how we finance that spending.

- Government investment generates large positive returns, just like private investment.

- We should focus on opportunities net of their costs.

- Our largest asset class is ourselves: our lifetime incomes and satisfaction are directly tied to our investments in ourselves through education.

- Government has to be the investor; private markets cannot invest in people.

-

"Noble Vocation or New Idolatry? Business Leadership Lessons from Pope Francis"

Chris Lowney, Author and Chair of the Board of Catholic Health Initiatives

February 24, 2014Are you using your power to serve only yourself (new idolatry) or to serve others (noble vocation)?

According to Chris Lowney, business can be a noble vocation if you see yourself as being challenged by a greater meaning. Are you serving the common good? He used Bill Gates as an example of noble vocation.

In the lecture, Lowney also summarized the following three leadership lessons:

- "Missing the Train" - human beings are more important than profit margins; don't lose sight of the people in need

- "Praying Alone" - On Pope Francis's first day on the job, he headed to church to pray. Remind yourself why you're grateful. Mentally relive what happened and take away a lesson.

- "Doing Laundry" - Before he became Pope, Pope Francis's subordinates remember him doing the laundry. When you lead, you have to ask people to make sacrifices.

Lowney chairs the board of Catholic Health Initiatives, one of the nation’s largest healthcare/hospital systems with some $19 billion in assets. He is a one-time Jesuit seminarian who later served as a managing director of J.P. Morgan in New York, Tokyo, Singapore and London until leaving the firm in 2001. Lowney is the author of four books, including Heroic Leadership, Heroic Living and A Vanished World. His latest work, Pope Francis: Why He Leads the Way He Leads, explores the Pope's leadership approach and draws crucial life lessons that were highlighted in his lecture at LMU. He is a summa cum laude graduate of Fordham University, where he also received his M.A. He is holder of five honorary Doctoral degrees.

-

"Sustainability Performance: Managing, Measuring and Reporting"

Mike Wallace, Director of the GRI (Global Reporting Initiative) Focal Point USA

October 2, 2013Mike Wallace gave an in-depth overview of the current state of corporate sustainability reporting across the world. The Global Reporting Initiative is a leading organization in the sustainability field that promotes the use of sustainability reporting as a way for organizations to become more sustainable and contribute to sustainable development. According to a 2011 KPMG Sustainability Report, 95 percent of the 250 largest companies now report on their corporate responsibility activities. Interestingly, two-thirds of non-reporters are based here in the U.S. The GRI guidelines are currently in their fourth version and Wallace took time to explain how the guidelines have evolved over time and some of the newest disclosures. Companies now must publish a GRI content index in order to classify as a GRI-based sustainability report.

Awareness and uptake of sustainability reporting has increased dramatically in recent years. Many organizations consider sustainability reporting to be necessary and beneficial. But growth in sustainability reporting needs to be exponential for it to become a standard business activity. All of the major stock exchanges now report corporate sustainability performance as well as the Bloomberg Terminal. More and more governments are also making sustainability reporting mandatory. Wallace’s presentation was very enlightening and made a strong case for sustainability’s future impact on the global corporate landscape.

With nearly 20 years of international experience in the sustainability field, Wallace has worked with corporations, nonprofits and government agencies on the development, implementation and integration of sustainability programs. He is a recognized expert in the field, speaks and writes internationally on the subject of sustainability and reporting, and has inside knowledge on how the financial markets use sustainability information.

-

"How Corporate Governance Can Save (or Ruin) the World"

Nell Minow, Co-Founder and Board Member of GMI Ratings

April 15, 2013Nell Minow was named one of the 20 most influential people in corporate governance by Directorship magazine in 2007 and was dubbed “the queen of good corporate governance” by BusinessWeek Online in 2003. Prior to co-founding The Corporate Library (now GMI Ratings), Minow was a Principal of Lens, a $100 million investment firm that took positions in underperforming companies and used shareholder activism to increase their value.

In her rousing presentation, Minow shared some of the most shocking examples of bad corporate governance she’s encountered throughout her impressive career. These examples, many of which were laughable, were a stark lesson on what not to do. She said the financial crisis was caused by one reason: incentives. Minow also touched upon executive compensation, corporate greed and the lengths to which companies are willing to cover up messy situations. A reception was held after her presentation to give students the opportunity to introduce themselves and ask questions.

Minow previously served as general counsel and then president of Institutional Shareholder Services. She taught MBA students at George Mason University for five years. She has been profiled in the New Yorker, The Economist, The New York Times, and the Washington Post and appeared as an expert in corporate governance before many Congressional and Senate hearings and on television in the United States, the UK, and Canada. She is a graduate of Sarah Lawrence College and the University of Chicago Law School. Minow is also a movie critic who reviews new releases and DVDs each week at moviemom.com and on radio stations across the country.

-

"Rising from the Ashes of the Global Financial Crisis: Moving Toward a More Sustainable Global Financial System"

Stephen Young, Global Executive Director of the Caux Round Table

November 5, 2012Stephen Young’s presentation was particularly timely on the eve of election night, as our nation continues to struggle with finding solutions to our economic problems. According to Young, one thing became abundantly clear with the global financial crisis: the efficient market hypothesis - that free and largely unfettered markets will find stable equilibriums - is simply wrong in practice. The financial markets, left to their own devices, proved to be anything but well behaved and showed little ability to self-correct. In his lecture, Young proposed that a different paradigm must be adopted by government, business enterprises and business schools to ensure the viability of the global banking and financial system – one in which the strategic interests of owners and managers is more aligned with those of relevant stakeholders.

Young shared a map displaying the components of US debt as a fraction of GDP and the finance sector saw the largest increase. He said that the markets are often mispriced and the theory of trusting markets is not adequate. Young also discussed the “agency theory,” which argues no one can be a faithful agent as we are all too self-interested and so governed more by short-term rationality than by long-term rationality. He concluded his powerful lecture by providing an overview of the moral responsibility for businesses and how important it is to get back on track before things get even worse.

-

"Fiscal Sustainability and Tax Reform"

Hon. David Walker, Founder and CEO of the Comeback America Initiative

October 25, 2011Hon. David M. Walker is founder and CEO of the Comeback America Initiative (CAI) and former comptroller general of the U.S. As president, founder and CEO, Walker leads CAI's efforts to promote fiscal responsibility and sustainability by engaging the public and assisting key policymakers on a non-partisan basis to help achieve solutions to America's federal, state and local fiscal imbalances.

Speaking to a packed auditorium at the College of Business Administration, all eyes and ears were on Walker as he revealed disturbing statistics about the state of the U.S. budget deficit. Using charts and graphs to illustrate America’s escalating financial problems, Walker firmly stated what two things are needed to turn this country around: better leadership at the top and action from young America.

-

"Financial Regulatory Reform: The SEC Moving Forward"

Luis Aguilar, Commissioner at the U.S. Securities and Exchange Commission

September 21, 2010Luis A. Aguilar spoke to a packed audience at Loyola Marymount University’s College of Business Administration on Sept. 21, as part of the Distinguished Speaker Series. Aguilar discussed the impact the Dodd-Frank Wall Street Reform and Consumer Protection Act will have on the SEC, and discussed the principles he thought should guide the SEC’s decision making as it complies with the new requirements. As the presentation closed, Lawrence Kalbers, R. Chad Dreier Chair in Accounting Ethics and director of the Center for Accounting Ethics, Governance, and the Public Interest, presented Aguilar with the Accounting in the Public Interest Award, in recognition of “his dedication and leadership in protecting investors and the public.”

-

"The Economic Crisis: Bad Loans, Bad Gatekeepers and Bad Regulation"

Lynn Turner, Former Chief Accountant at the U.S. Securities and Exchange Commission

March 9, 2010Lynn E. Turner gave an entertaining and insightful, albeit somber, overview of the current economic crisis in which the global community finds itself. His presentation, “The Economic Crisis—Bad Loans, Bad Gatekeepers, and Bad Regulation came almost exactly one year after the U.S. stock market indices reached their lows during this financial crisis. Turner addressed a packed audience, frankly outlining the micro and macro fundamentals that led to the financial crisis including a culture of “me, not we,” excessive deregulation, and multiple congressional conflicts of interests. Turner also warned that recovery would be a slow and tedious process.

As he concluded his speech, Turner jokingly concluded his talk with “my condolences to the young people, but thank you for paying the bills.” Dr. Lawrence Kalbers, R. Chad Dreier Chair in Accounting Ethics and director of the Center, formally closed the lecture by presenting Turner with the Accounting in the Public Interest Award from the Center for Accounting Ethics, Governance, and the Public Interest in recognition of ethical leadership and values in his service to the public and the accounting profession.

-

"The Banking Crisis, Debt and Ethics"

Charles Bowsher, Former Comptroller General of the U.S.

October 21, 2009During his visit, Mr. Bowsher met in small groups with students and faculty throughout the day. In the evening, he gave an informative, timely and candid presentation titled, “The Banking Crisis, Debt, and Ethics,” to a standing-room-only audience of more than 300 students, faculty, alumni, and guests from the community. Bowsher was presented the Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest. The award was given in recognition of Mr. Bowsher’s “recognition of his ethical leadership and values in his service to the public and the accounting profession.”

-

"Global Ethics and Auditing Standards for the 21st Century"

Robert Bunting, Chair of the International Services Group at Moss Adams LLP

March 17, 2009During his visit, Mr. Bunting met in small groups with students, faculty, and professionals. In the evening, he gave a very timely presentation titled, “Global Ethics and Auditing Standards for the 21st Century” to an audience of about 150 students, faculty, alumni, and guests from the community. In his presentation, he discussed the development and implementation of global ethics and auditing standards and their importance to the global economy, financial reporting, and corporate governance. His remarks also addressed the current financial crisis and the need for a thoughtful, measured, and coordinated response by regulators worldwide. After his presentation, Bunting was presented the Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest in recognition of “his leadership and commitment to ethical standards and values in the accounting profession.”

-

"A Perfect Storm of Investigation and Governance Failures: Why Enron Failed and Why Its Failure is Relevant Today"

John Hueston, Former Lead Trial Prosecutor for U.S. v. Kenneth Lay and Jeffrey Skilling (Enron)

October 15, 2008John Hueston came to campus as part of the Distinguished Speaker Series. During his visit, Mr. Hueston met in small groups with students and faculty throughout the day. In the evening, he gave an informative presentation titled, “A Perfect Storm of Investigation and Governance Failures: Why Enron Failed and Why Its Failure is Relevant Today,” to an audience of about 250 students, faculty, alumni, and guests from the community. Hueston was presented the Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest. The award was given in recognition of Mr. Hueston’s “commitment to the pursuit of justice and his dedication to the public interest.”

-

"Perfectly Legal: Inequities in America"

David Cay Johnston, Investigative Journalist

April 16, 2008David Cay Johnston came to campus as part of the Distinguished Speaker Series. Johnston, long one of America’s top investigative reporters, joined The New York Times in 1995 and in 2001 won a Pulitzer Prize for his reporting on the U.S. tax system. His 2004 best-selling book, Perfectly Legal : The Covert Campaign to Rig Our Tax System to Benefit the Super Rich--and Cheat Everybody Else, won a medal from Investigative Reporters and Editors as book of the year. His most recent book, Free Lunch: How the Wealthiest Americans Enrich Themselves at Government Expense (and Stick You with the Bill) , is about how government economic policy violates Adam Smith’s teachings. During his visit, Mr. Johnston met in small groups with students and faculty throughout the day. In the evening, he gave an enlightening and provocative presentation titled, “Perfectly Legal: Inequities in America,” to an audience of more than 350 students, faculty, alumni, and guests from the community. Johnston was presented the Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest. The award was given in recognition of Mr. Johnston’s “ongoing investigative reporting about our tax and legal systems and for his commitment to social justice and the public interest.”

-

"Ethics in Everyday Business"

R. Chad Dreier, President, Chairman & CEO of The Ryland Group

February 12, 2008R. Chad Dreier came to campus as part of the Distinguished Speaker Series. Dreier is president, CEO, and chairman of the board of The Ryland Group, a Fortune 500 company. He is an accounting graduate and the chairman of the board of trustees of Loyola Marymount University. During the day, Mr. Dreier met in small groups with students and faculty. In the evening, Mr. Dreier gave a motivational and educational presentation titled, “Ethics in Everyday Business,” to an audience of about 400 students, faculty, alumni, and guests from the business community. The audience reacted very positively to his message and down-to-earth approach. Dreier was presented the Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest. The award was given in recognition of Mr. Dreier’s “ethical leadership and integrity in business, and personal and financial support to Loyola Marymount University and many other community organizations.”

-

"Ethics and the Whistleblower"

Bunnatine (Bunny) Hayes Greenhouse, Former Chief Contracting Officer of the U.S. Army Corp of Engineers

September 24, 2007Mrs. Bunnatine (Bunny) Hayes Greenhouse, best known for challenging improper Iraq no-bid contracts, came to campus as part of the Distinguished Speaker Series. During the day, Mrs. Greenhouse met in small groups with students, faculty, alumni, and guests from the Los Angeles community. In the evening, Mrs. Greenhouse gave an inspiring and informative presentation titled, “Ethics and the Whistleblower,” to an audience of nearly 400 students, faculty, alumni, and guests from the business community. Mrs. Greenhouse also was presented the Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest. The award was given in recognition of Greenhouse's “ethical leadership, integrity, and distinguished service in the public interest.”

-

"WorldCom Warnings: What Went Wrong and Corporate Governance Lessons Learned"

Cynthia Cooper, Former Vice President of Internal Audit at WorldCom

November 8, 2006Ms. Cynthia Cooper, best known for her role in uncovering the $11 billion fraud at WorldCom, was the first to visit campus as part of the Distinguished Speaker Series. During the day, Ms. Cooper met with students in the accounting ethics class, had lunch with faculty and the dean, and later met with another small group of faculty and students. In the evening, Ms. Cooper gave an inspirational and informative presentation titled, “WorldCom Warnings: What Went Wrong and Corporate Governance Lessons Learned,” to an overflow crowd of more than 500 students, faculty, alumni, and guests from the business community. Ms. Cooper also was presented the first Accounting in the Public Interest Award by the Center for Accounting Ethics, Governance, and the Public Interest. The award was given in recognition of Ms. Cooper’s “ethical leadership, professionalism, and distinguished service in the public interest.”